Source: Westend61 / Getty

The ultimate #1 rule when dealing with finances is to always spend less than you make. I know that might seem a little obvious but it’s extremely hard to do and impossible to do without creating a monthly budget.

Sign Up For Our Newsletter!

It’s been reported in Stress in America: Paying with Our Health, that nearly 72 percent of Americans suffer from financial stress. If you consider yourself to be a part of this statistic you may find yourself sinking into a pile a debt. Something like standing at the bottom of a ladder and looking up just to realize you have a long way to climb.

I know this feeling to be true but the good thing is, there’s only one way to go…UP! Suffering from financial stress can be detrimental to your progress. It causes headaches, setbacks, and at times the feeling of failure. I myself once suffered from this horrible plague.

Related: Millennial Money: Unmasking the Millennial — Realizing Your Identity In Today’s Generation

Although financial hardship is not an actual illness, it can often feel that way and once you’ve fallen victim, it’s hard to see the positive in life. Being broke is not a joke but regardless of what things may look like now, there are better days ahead.

To avoid the plague of financial hardship you must prepare yourself: mentally, physically, and even emotionally.

The definition of true success can vary from person to person. Everyone has personal goals or ideas that people will either gravitate to or not understand at all. It is key that you protect your goals and vision. Truth be told, a lot of ideas that you might have floating around may have already been thought of. The only thing that sets your dream apart is YOU. Be unique in your approach. What can you bring to the table that no one else can?

Related: Millennial Money: Money Makeover

When I started this blog I was eager to share information because I am currently walking the same path that I’m speaking of. I had to do some true soul searching before I could actually see some progression.

Knowing exactly who you are and what makes you great will take you a long way on the road to success.

In my previous article, Recycled Money, I spoke about ways to produce extra income just by doing simple things that you love to do. Before moving forward check it out, if you haven’t already. Write down a list of 3 things that you do that can possibly become an extra paycheck.

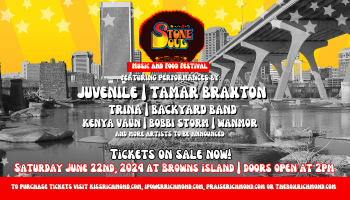

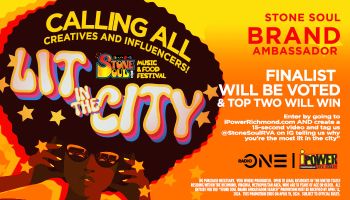

For the Latest Entertainment News: Follow @‘ipowerrichmond’

After that, put some extra thought behind each idea: WHAT is your goal? HOW can it benefit others? WHEN should you initiate this plan? To be real sometimes the solution to better money habits is not always just saving money but instead making more money. When trying to save money you are limited to the number of ways you can save, but the number of ways to make more money is unlimited!

If you want others to take you and your ideas seriously, self-branding is vital. The image of your brand will be how people view you without actually seeing you if that makes any sense.

Passions can turn into paychecks but you have to put the work behind your vision.

The next few weeks I will be working towards bettering self-branding. The mission this week is to find your own brand. Before you can reach the top of a ladder you have to start at the bottom. In order to get closer, you have to take each step at a time. Sooner or later you’ll be able to look down and see how far you’ve come.

The same thing for financial freedom. You can’t be afraid to put in the work — unless your last name is Trump or Hilton, and you were born into millions.

As millennials, we have to grind to get where we want to be. It won’t happen overnight but once you place that first foot on the ladder, one step soon turns into ten and ten turns into being on top!

Latest…