Source: kate_sept2004 / Getty

Sign Up For Our Newsletter!

What is your monthly net income? Take just a minute to think about that. Think of all the things that bring you financial increase during the month.

The first step to creating an effective budget is knowing exactly what you’re working with. Once you figure out your monthly income and pick 3 categories for your budget plan, you now have the key!

I previously stated that you must be realistic about your lifestyle when choosing your 3 categories. As much as we all would love to, we cannot have a “Beyonce budget.”

Related: The Importance Of Financial Literacy

If you want to eventually have more, you must be able to manage what you already have. Being able to control the little will set the foundation to generate A LOT.

Not including my monthly bills, I was able to narrow down the specific areas my funds go to each month. I concluded that I spend too much money doing these 3 things: Going out to eat, buying shoes or clothes, and believe it or not, going on occasional trips. No, I don’t go on trips every single month, but I love to travel so why not start a separate budget just for my getaways? If you like to travel … add that!

You may end up with more than 3 categories and that is perfectly fine. That just means you were more honest with yourself than I was!

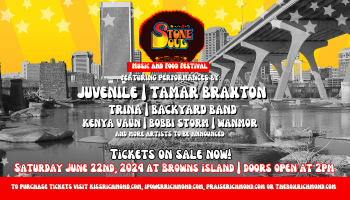

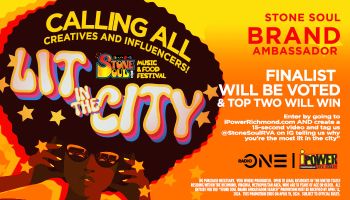

For the Latest Entertainment News: Follow @‘ipowerrichmond’

What’s next? It’s time to record. Over the next week save all your receipts from places that fall into either of your categories. Saving these will give you a better idea of how much you spend roughly a month. During this week it is okay not to adjust any of your habits. In order to see a change, you have to first see the problem! If you have other people that contribute to your spending in any of your categories, get them on board too. A budget plan will not be effective if you are not on the same page.

As the week goes on and you begin to track your spending there are a few things that I think will

contribute to your organization. Run into your local staples and pick up a small budget book. This

organizer will assist you in your journey. A basic budget planner cost around a whopping $10.00 and will outline each month that way you can start developing some clear goals for the future. This book also has designated space for paid and unpaid statements and also small pockets so you can store things like receipts, personal reminders, etc.

We are well on our way guys! This is just the beginning but you can’t build something great without a strong foundation. It’s time to ball….on a budget!

Latest…